In brief

In brief - Finances TI360

Our blog

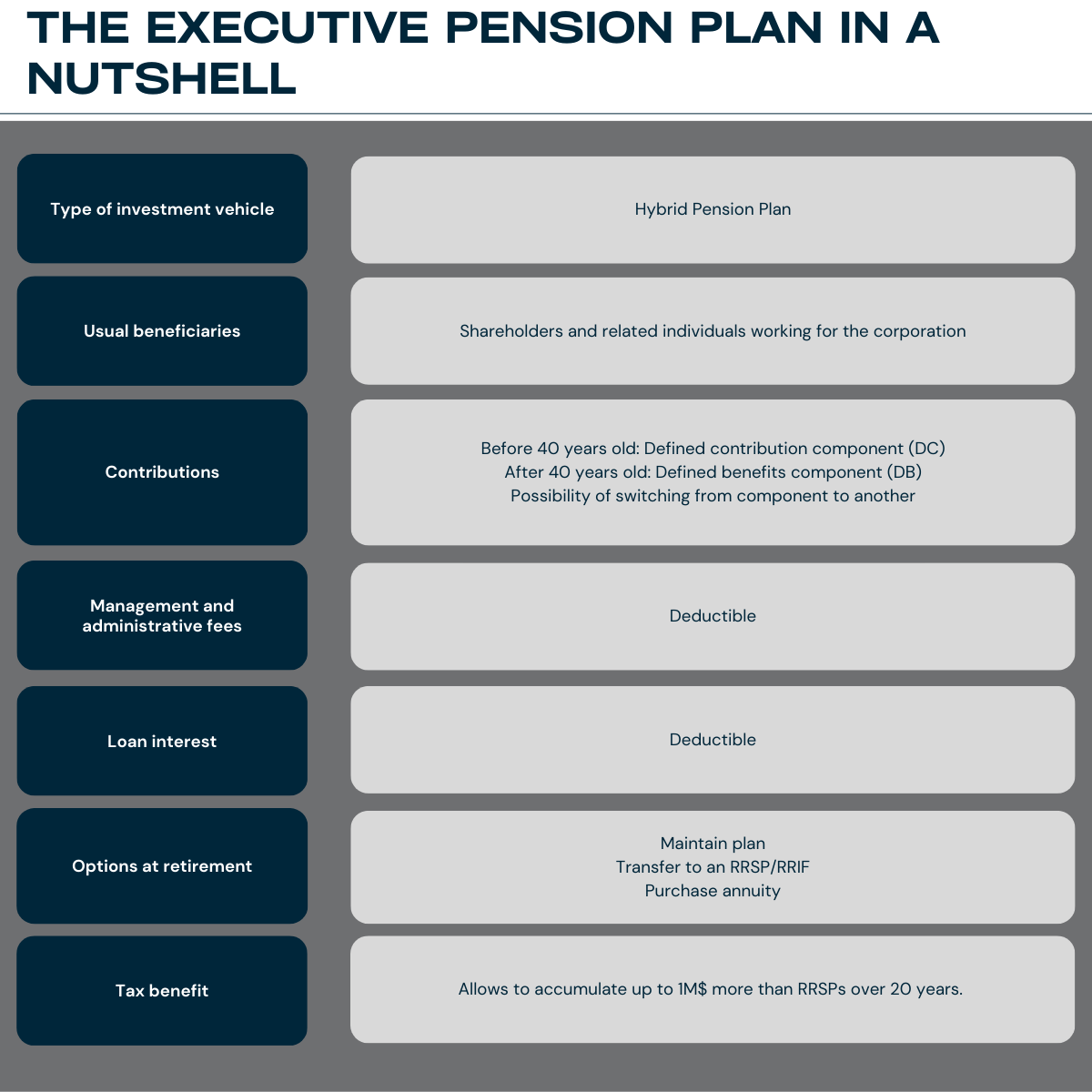

The « Executive Pension Plan », an unknown vehicle for retirement

Article By Dany Provost in “Les Affaires”, October 2018 edition.

Starting now, entrepreneurs et small business owners should seriously study this option for their retirement.

We’re talking about the Executive Pension Plan. This solution, approved by the Canada Revenue Agency, is an improved version of the Individual Pension Plan (IPP).

But first, what’s an IPP you may ask?

Basically, an IPP is a defined benefits pension plan whose beneficiary(ies) are shareholders or key employees of an SME. The primary benefit compared to the Registered Retirement Savings Plan (RRSP) is the higher contribution room after 40 years old. In other words, it allows for greater tax-free accumulation than an RRSP. Generally funded entirely by the employer, each dollar contributed is deductible.

Above higher annual contributions, it is also possible to buyback past service years to create a larger first year contribution. Even if rules were tightened in 2011, they still exist if the shareholder was compensated in the form of a salary (not dividends). Each year in which a salary has been paid can be redeemed.

Also, when the plan has a deficit, additional contributions can be made as well. One can purposely generate deficits by investing in fixed-income securities when actuarial assessments have an imposed limit by the law of 7.5% return per year. If the fund’s return is lower than 7.5%, it will create a deficit which will make it possible to contribute even more in the future.

Another advantage over an RRSP is that the management fees are deductible for the employer each year. This means additional savings.

However, the popularity surrounding IPPs in Canada is not great. According to my information, less than 12 000 of these plans are registered to the Canada Revenue Agency.

It must be said that entrepreneurs, unlike employees, have other options for accumulating retirement capital: passive income generated by investments made within a holding company. The difference in income is sometimes not great between a scenario where sums are accumulated in an IPP and another where the sums remain in the company.

That being said, with the new taxation rules affecting SMEs since 2019, we want to limit investment income in the company (or in associated companies) I order to maintain the 500 000$ threshold beyond which the investment strategy involving a company will no longer be beneficial.

In this context, we may want to limit investments that could harm the company and invest in vehicles such as an IPP.

But the Executive Pension Plan in all this?

It’s an individual pension plan (IPP) to which two components are added: a defined contribution component (DC) and a flexible component (AVC).

If the plan has a surplus, i.e. assets exceed liabilities by more than 25%, a simple switch to the defined contribution component will allow contributions of 25 000$ for the following years (for a 150k salary), whereas a contribution pause would have been required in most traditional IPPs.

There are also other advantages to the Executive Pension Plan, particularly in terms of estate planning with a possible intergenerational transfer. The thing to remember is that if a business owner wants to maximize his RRPS, he has every reason to look at the Executive Pension Plan.

Actuary, Tax expert and financial planner